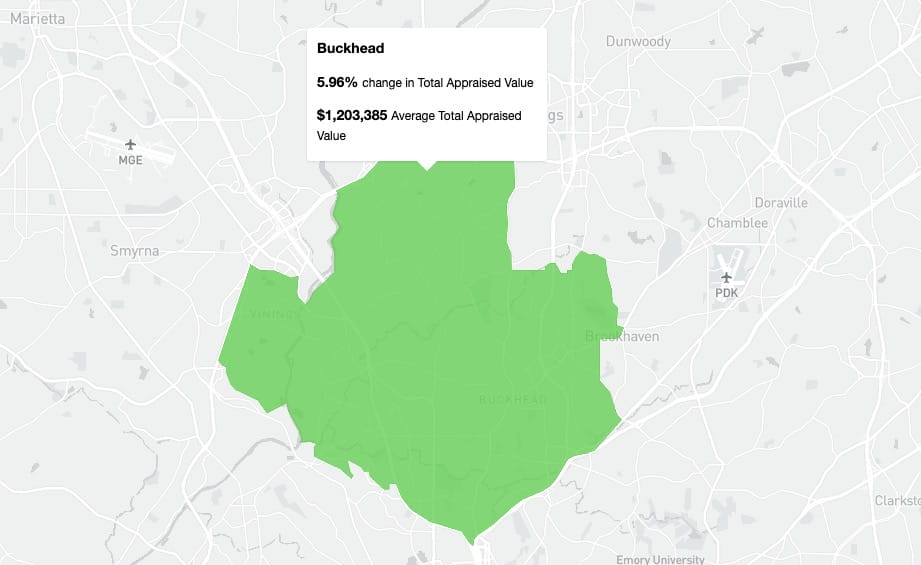

The average home in Buckhead saw an increase in value of 6.97% according to the Fulton County Tax Assessor as compared to 2020. While escalating property values is good news for homeowners, it can result in increased property taxes….and no one really enjoys paying taxes! If you did not receive your new notice of assessment in the mail, then you can look up your assessment online here. You may file an appeal online at this link If you feel that the valuation of your home is too high. This process can be complicated, so consider hiring one of the professionals below to handle it for you. The 2021 appeals deadline for appeals is August 5, 2021.

Property taxes are calculated based on a complex system of county and city millage rates, which can make them hard to understand. I analyzed property tax bills in the local jurisdictions below in order to calculate the the property taxes as a percent of the home value.

In the table below I have compiled the property tax rates for Buckhead and also included a comparison to Vinings property taxes and Sandy Springs property taxes. Everything is updated based on the most recent tax bills:

| Area | County Tax | City Tax | Total Tax % | Annual Tax On $1 Million Home (With No Exemptions) | ||

|---|---|---|---|---|---|---|

| Buckhead | Fulton | 0.39% | Atlanta | 1.24% | 1.63% | $16,280 |

| Sandy Springs | Fulton | 1.11% | Sandy Springs | 0.19% | 1.30% | $12,990 |

| Vinings | Cobb | 1.21% | Unincorporated | 0.00% | 1.21% | $12,140 |

| Brookhaven | Dekalb | 1.07% | Brookhaven | 0.19% | 1.26% | $12,590 |

Buckhead Property Taxes Based On Purchase Price

When shopping for a home in Buckhead (or anywhere in Georgia), the most important thing to know is that the year following your purchase, you will be taxed at the rates above based on what you paid for the home. Many buyers look only at what the sellers current taxes are….that is not always a proper reflection of what you can expect your taxes to be.

Property Tax Exemptions

The tax rates shown above are pretty much worst-case scenario. Many tax payers qualify for a variety of exemptions that reduce their property taxes every year such as:

- Homestead Exemption

- Senior Exemption

Expert Advice On Contesting Your Buckhead/Atlanta Tax Assessment

Below is a helpful Q & A I had with some of the best local Buckhead professionals who will assist in filing your property tax appeal. Have you had a good experience with another expert? If so, let us know in the comment section below!

Campbell & Brannon Property Tax Services

Q: Does it make sense for people to file an appeal on their own. Why hire a professional?

A: Most people have no idea what information to present and what format it needs to be presented in.

Q: How long does the process of appeal take and what should people expect?

A: Appeals normally take between 6-12 months.

Q: Does filing an appeal have any downsides? Could it backfire in a possible further increase? Does it give the assessor the right to conduct an internal inspection of your home?

A: If you are trying to hide something from the county like extra square footage or finished basements or something that the county does not know about you better weigh it if it is worth it or not because it will likely come out in the open. The county does not need to come in unless you ask them to.

Costs: Our Professional Appeal service is $500 admin fee plus 25% contingency fee on the first years’ tax savings

Contact:Campbell & Brannon Property Tax Services

One Buckhead Plaza

3060 Peachtree Road, Suite 1735

Atlanta, GA 30305

Phone: (404) 924-7040

Email: ehale@campbellandbrannon.com or jelrod@campbellandbrannon.com

www.campbellandbrannon.com

Preferred Tax Services

Q: Does filing an appeal have any downsides? Could it backfire in a possible further increase? Does it give the assessor the right to conduct an internal inspection of your home

A: Yes, filing an appeal is not advisable in all situations. In a way, filing an appeal is shining a spotlight on your home. So if you have recently pulled a construction permit to improve your home or have it listed at a value higher than your current Notice Value, an appeal would not be recommended. At the regular appeals level, you do not have to allow any county representatives into your home, though they do have the right to walk around your property.

Q: What other advice would you give people?

A: I would recommend that all property owners check to see if they qualify for a homestead exemption. Fulton County’s different exemptions and qualifications for each exemption can be found at: www.fultonassessor.org

Costs:We charge a contingency fee based on tax savings.

Contact:

Preferred Tax Services

Piedmont Place Office Building 3520 Piedmont Road, Suite 200 Atlanta, GA 30305

404-262-200

Preferredtaxservices.com

Residential Contacts:

Leah Cadray leahcadray@preferredtaxservices.com

Jay Dermer Jaydermer@preferredtaxservices.com

Commercial Contacts:

David Dermer Daviddermer@preferredtaxservices.com

Adam Richmond Adamrichmond@preferredtaxservices.com

Equitax

Q: Does it make sense for people to file an appeal on their own. Why hire a professional?

A: A reduction in a parcel’s property tax assessment directly correlates to a lower property tax bill for the parcel. Unlike the local tax rate (or “millage rate”), which is typically non-negotiable, the assessment of a parcel is a negotiable factor. The tax rate is typically set by community officials, state and local politicians, and local school boards. The assessment is, however, a negotiable factor. The key in petitioning for a lower assessment lies in understanding the assessment process, recognizing the appraisal methods utilized, and identifying the reasons why a property might be entitled to an assessment reduction. Of course, presenting accurate and persuasive evidence in a succinct, knowledgeable, effective, and professional manner is critical to winning an assessment appeal. That’s where EQUITAX can help!

Q: Does filing an appeal have any downsides? Could it backfire in a possible further increase? Does it give the assessor the right to conduct an internal inspection of your home?

A: There are times when filing an assessment appeal is not advisable. Doing so may open the door for even higher taxes. This is another reason for getting a professional involved in a tax appeal case. The Tax Assessor does not have the right to inspect the interior of one’s home, unless the appeal has been filed to Fulton County Superior Court.

Contact:

Email: Support@equitaxusa.com

Phone: (404)351-5354

Website: www.equitaxusa.com

Principal: David Humphreys

Disclaimer: This information is only an estimate and you should check with your local tax commissioner for your exact tax rates. Taxes are also subject to change.