The beginnings of the pandemic stopped the Buckhead real estate market in its tracks. I wrote about the early effects in March and April:

“The global uncertainty, drop in the stock market, and travel limitations have suddenly tapped the brakes on an otherwise healthy Buckhead real estate market. It’s happening at the worst time of year – when the spring selling season typically kicks into high gear as families look to buy and sell before school begins again in the fall.” – March 2020 Update

From where things stand today, that feels like a decade ago. I represent more homes scheduled to close in the next 30 days than I sold in the first six months of the year (I will still be behind for the year). What caused this massive shift? It seems that people have become a lot more familiar with their homes after spending months cooped up, and many have decided it is time to upgrade. Instagram images of friends lounging in their steaming heated pools during the crisp March lockdown have literally shifted the market preferences, making a pool in the backyard a must-have for many.

In addition to the local buyers trading up, we are still seeing an influx of buyers from other regions who are heading to Atlanta for better jobs, improved quality of life, or both.

Record Low Interest Rates

You have heard low interest rates being touted for several years now, but they have now set multiple record lows over the last 4 weeks. Just yesterday the average 30-year fixed rates slid to another record of 2.92% according to Mortgage News Daily. My more aggressive lenders are offering more creative products with some rates below 2.5%. That said, the lenders have raised their standards, making it harder to qualify for these amazing deals. The standard down-payment on large purchases is now 30% instead of 20%. This incredibly cheap money is certainly providing more purchasing power to buyers and boosting the market in turn.

Buckhead Real Estate Market Stats – First Half Of 2020

The respected Case-Shiller Index shows metro Atlanta as a whole saw a 4.7% home price increase year-over-year for March 2020, their latest available data. In Buckhead, we have seen a lot of demand across the market but the story is more nuanced.

The charts and data below paint a vivid picture for those that love to take a deep dive. For those that just want to know the quick facts:

- The number of Buckhead homes for sale is down 13%.

- The number of homes sold started off strong, but sharp declines have left us 10.1% lower than last year.

- 3rd-quarter home sales are expected to be stronger than last year, narrowing the gap.

- The average sale price of Buckhead homes was at $1.2 million in June, up 7% over the same month last year. This reverses declines seen in April and May.

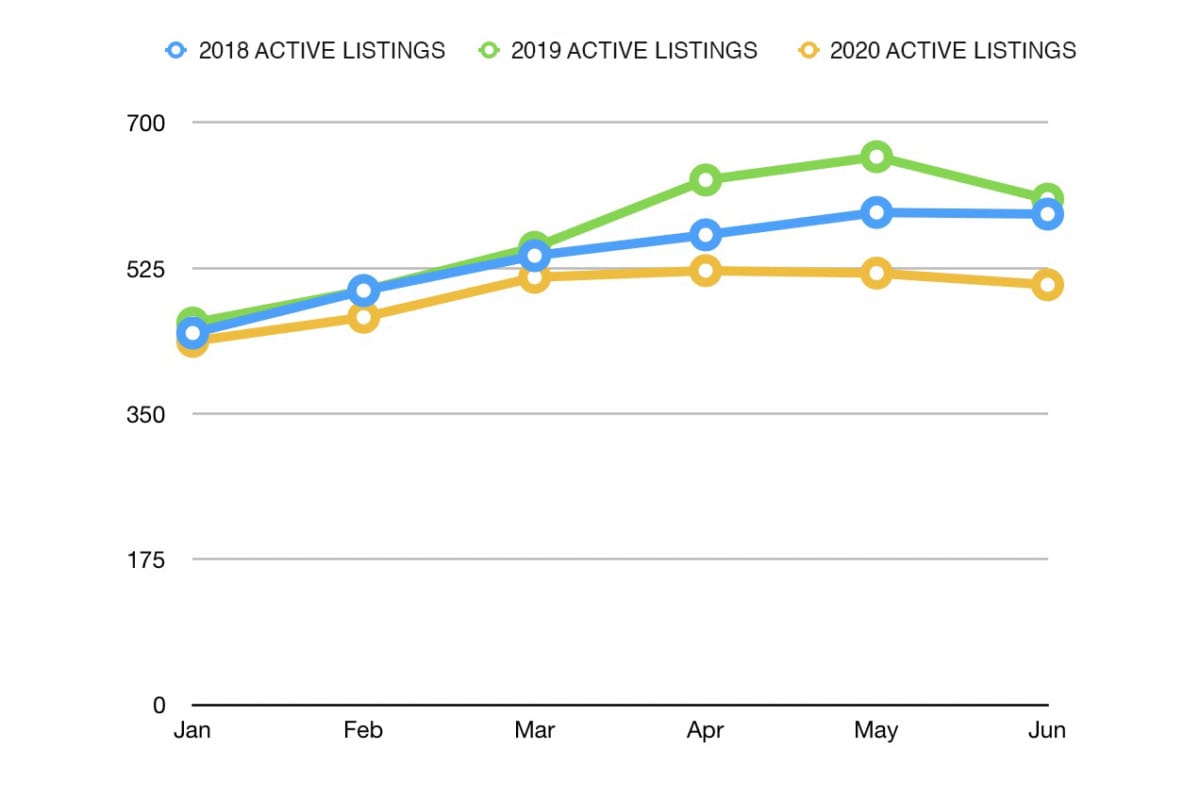

Inventory Is Down

Many buyers currently in the market for a home in Buckhead would be quick to tell you that there are not as many options available as they would like. The data shows that they are correct! Inventory of active single-family listings in FMLS was 13% lower during the first 6 months of 2020 than in the same period last year:

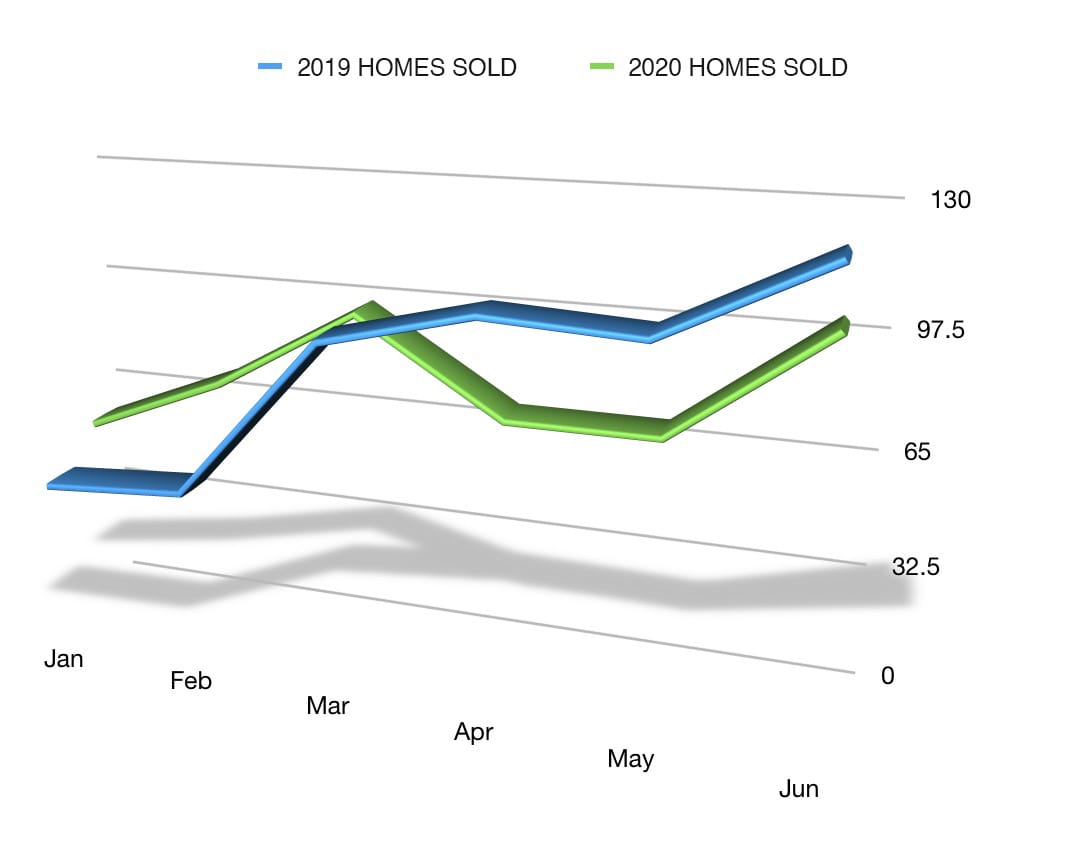

Sales Started the Year Off Strong But Are Now Playing Catch-up

I think the chart below is the most interesting. It clearly shows that sales for the first three months of the year were at a stronger pace than 2019. The 2nd quarter saw a significant drop, but the gap started to narrow in June. Year to date sales are down 10.1%. I would predict that the 3rd quarter sales of homes in Buckhead may actually outpace last year’s sales:

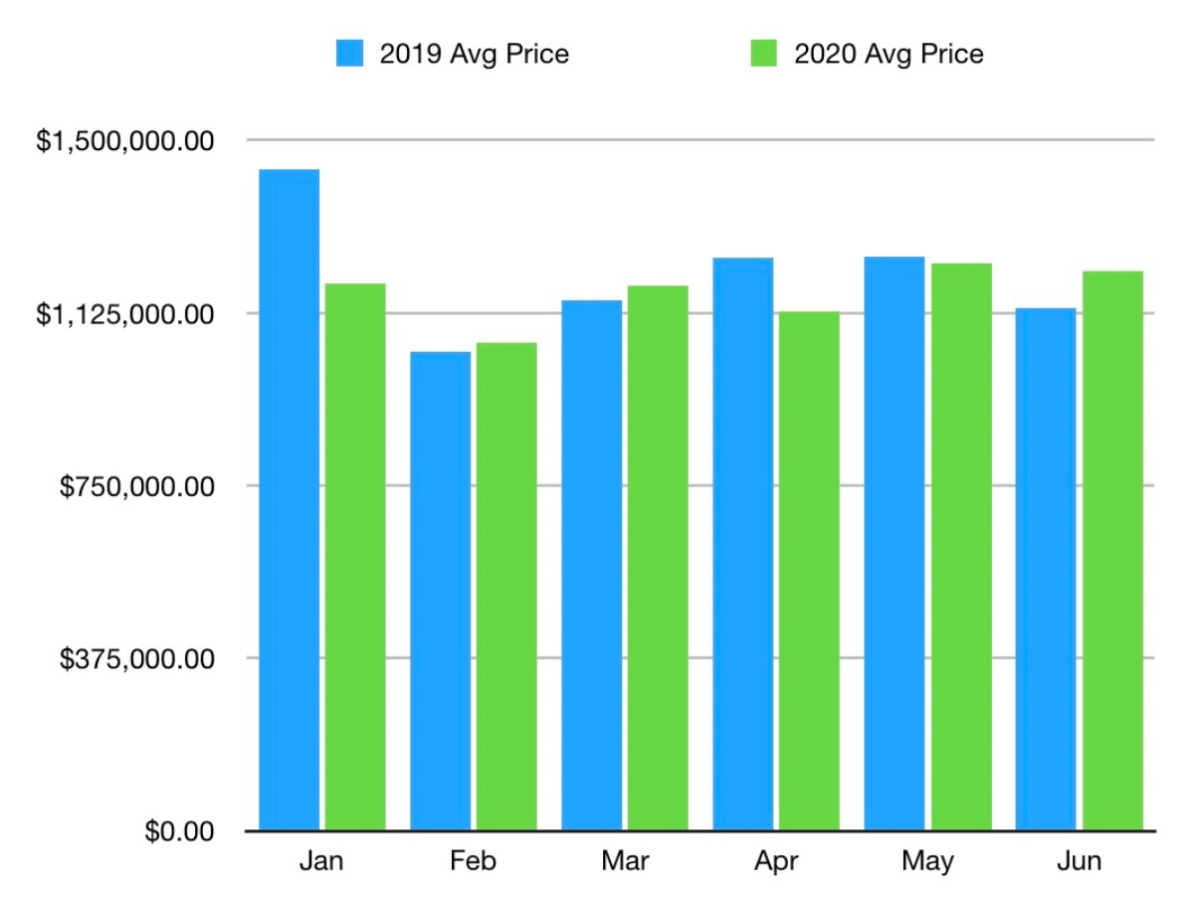

Average Sale Price Of Buckhead Homes Increases to $1.2 Million

The average sale price of Buckhead homes was at $1.2 million in June, up 7% over the same month last year. This reverses declines seen in April and May but 2020 is still down year-over-year by about 3.4%.

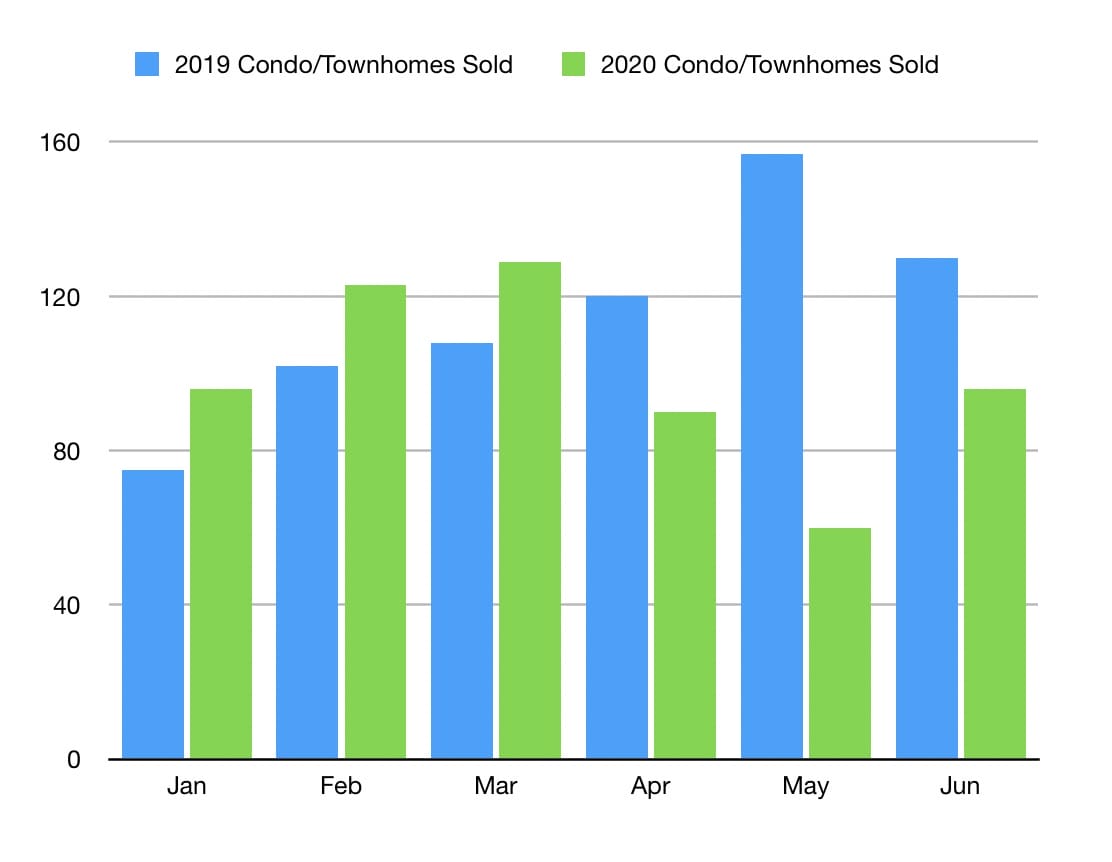

Buckhead Condominiums and Townhomes Experiencing Different Dynamics

All of the stats above show where the market is for single-family homes, the dominant product in Buckhead. The condo and townhouse market has proven to more susceptible to the effects of the pandemic as buyers seek more social distance:

- Year-over-year average prices are down to $380,000. A 3.4% drop, the same as single-family homes.

- Inventory of condos and townhomes is currently around 20% higher than last year.

- The first quarter saw a strong increase in sales, but the pandemic caused a steep decline of 40% in Q2 vs the same period in 2019

- Sales above $1 million have fared slightly better with a decrease in transactions of 32%.

What Should YOU Do?

It depends. It seems we are in the middle of this unprecedented story, not the end. The market is very nuanced. Whether now is the best time for you to make a move will depend on many factors. Contact me today if you need advice for your situation.